How Small Business Accounting Software Is Going To Change Your Business Strategies.

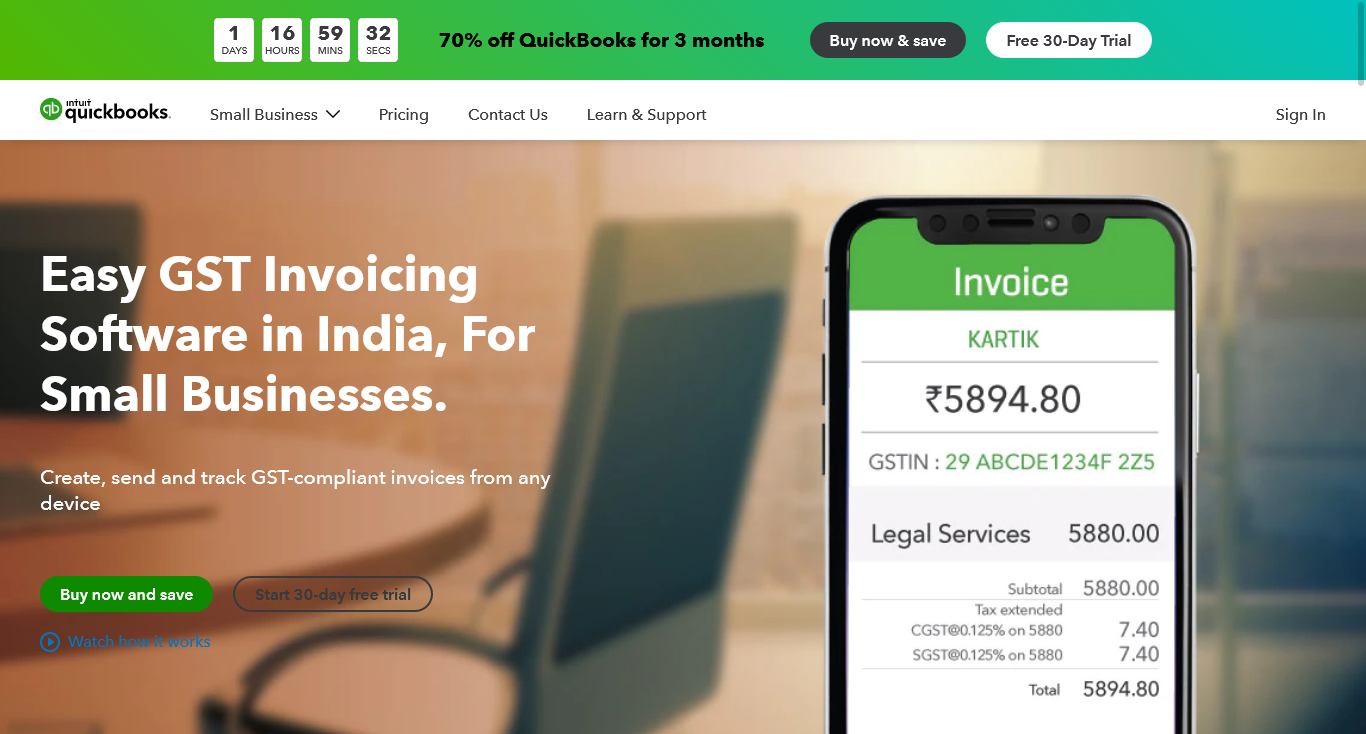

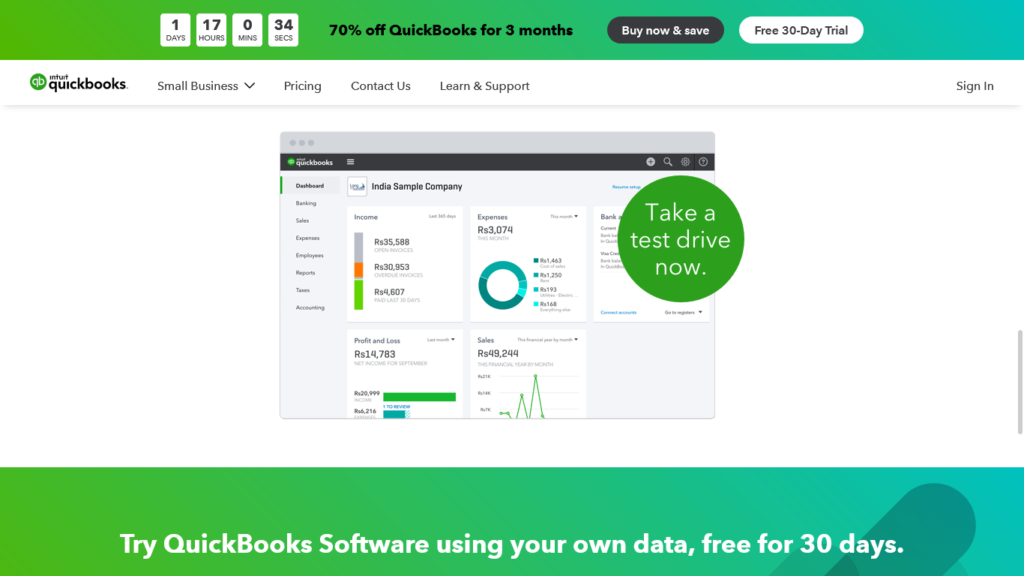

QuickBooks Desktop as small business accounting software now sells Pro, Premier, and Mac products only as Pro Plus, Premier Plus, and Mac Plus subscriptions. QuickBooks Desktop Enterprise has been offering subscription services for several years. Using QuickBooks Desktop as a subscription offers enterprises the following benefits:

Access to the latest version of small business accounting software with the latest features, security arrangements, and support for third-party operating system changes

1. Up to 38% faster and more dependable QuickBooks computing power (64-bit)

2. Unlimited customer service for small business accounting software and data recovery at no additional cost ($ 299.99 / year)

3. Premium money management and time-saving features.

4. Rising productivity with QuickBooks Desktop mobile applications as small business accounting software.

Intuit account requirements for QuickBooks Desktop

Possessing an Intuit account of a small business accounting software provides a safe, one-source login to access all of Intuit's powerful products, including QuickBooks desktop software and connectivity services.

Log in to your QuickBooks file with your administrator credentials and select Company> User and Password Settings> Intuit Account User Management from the menu bar. The user set here can access the selected built-in application, but not the QuickBooks Company file. To grant access and permissions to company files, select Company> User and Password Settings> User Settings from the menu bar. For QuickBooks Desktop Enterprise from the menu bar, select Company> Users> Configure Users and Roles.

There are several access points for small business accounting software. Open the QuickBooks Desktop application from your mobile device, sign in and select Snap and Upload Bill. From the open QuickBooks company file, select Provider> Upload Invoices and Reviews from the menu bar.

Features: Use the QuickBooks Desktop mobile application as small business accounting software to take a picture of the seller's invoice or have the seller send the invoice directly to your personal QuickBooks email. Using artificial intelligence/machine learning algorithms, QuickBooks Desktop creates vendor invoice transactions from uploaded vendor invoices for review and approval. QuickBooks saves a digital copy of your invoice to the computer where the QuickBooks Desktop file is stored.

Accounts payable approval process

From the QuickBooks Desktop Enterprise menu bar, select Company> Transaction Tracking and Approval.

Manage cash flow by defining a flexible approval process for invoices from vendors you receive in small business accounting software. Delegate a sensitive payable account, making aware that the invoice approval process has taken place before processing the recipient's invoice. A handy dashboard in small business accounting software organizes invoices that require specific approval before they are paid. Both the accounts payable representative and the selected approver receive an email notifying them of the vendor's invoice status.

Customize and email vendor bill payment slips

To edit the payment, slip for your account, select List> Templates from the menu bar, and select the BillPay template of small business accounting software. If desired, from the vendor's invoice payment transaction displayed, select Manage Templates on the Layout ribbon. Print your newly customized account payment bill from the Payment Summary window, or optionally select File> Print Form> Account Payment bill from the menu bar.

Features: Maintain professional and consistent communication by sending customizable account payment bills to sellers increases trust in the working of small business accounting software. Modify the invoice payment slip to include the company logo along with the details of the payment made in QuickBooks.

Attach documents to QuickBooks using a mobile device

From your mobile device, log in to the QuickBooks Desktop application (free), select Documents, and follow the instructions.

Features: Use the free QuickBooks desktop mobile application as the small business accounting software to take useful pictures of your documents. Or, optionally, scan the document in the Attachment Center of QuickBooks Desktop. Effectively attach these documents to transactions or records, eliminating the need to keep a copy of the paper.

Choose from multiple email customer contacts

Select Customer> Customer Service Center from the menu bar. Choose from the customer record for which you want to create multiple email addresses. On the customer's invoice that appears, select Email or select File> Submit Form from the menu bar.

Function: Do customers email invoices from QuickBooks? Efficiently select an email from the email drop-down list associated with the customer record in the small business accounting software.

Small business owners disclose their top challenges in new QuickBooks survey

Middle-class people are starting a business in various industries at a rapid pace than the national average, growing 34% over the last decade, compared to just 1% of all other small businesses. Addressing the shortcomings that exist is the first step in understanding the financial resources and tools they need to achieve solvency. It is important for the long-term fortune and overall economic empowerment of this community. From lack of access to finance to limited knowledge of business financial tools and resources that hinder the success of Indian small business enterprises, a recent report clearly says.

Lack of access to small business loans

Small business owners in India often use their savings or get financial support from friends and family to start a business. According to the report, 95% of Indian small business owners say it is mandatory to save their money before starting a business as a safety net for business and personal expenses. Nearly 62% received financial support from friends and family.

Limited familiarity with managing business finances and cash flow

Important financial tasks such as billing, collection, invoice payment, and tax management are challenges for almost 74% of Indian small businesses. Over 21% describe these tasks as "very rewarding."

In addition, more than 69% of small business companies saw cash flow as an issue. A total overview of cash flow can show the true health of your business. Without a method to know where your business is, you can't make strategic decisions about the future, such as investing in equipment or paying off certain debts.

Bank and credit card usage is low.

Having a business bank account separates business and personal expenses and enables more efficient business cash flow tracking. In addition, business owners with business credit cards can benefit from simple expense tracking, probably high credit limits, and the benefits of building a business credit history for loan applications.

Top 5 challenges defied by Indian small business companies today:

Customize your business with COVID

Acquire more customers

Survive COVID

Take care of financial tasks

Increased sales/revenue

E-Invoicing in India: How can Zoho Books help?

The Indian tax and customs office recently announced that Zoho is an authorized provider of invoicing solutions for businesses in the Government of India.

VAT was implemented in India in 2017 with a standard tax rate of 5%, with certain limited types of transactions set to zero tax rate or tax exemption. The introduction of electronic invoices is the next major change in the VAT system, which will come into effect on December 4, 2020.

The purpose of this change is to streamline the billing process, strengthen VAT compliance and improve government tax revenues. Electronic invoices ensure that you follow a standard electronic invoice format, improving invoice interoperability and readability. This procedure also helps tax authorities find incorrect invoices by matching the tax credits entered with the taxes passed on the GST portal.

What is e-invoicing?

Electronic invoices are a verification method for companies to generate electronic invoices in small business accounting software. Tax invoices are sent to the GST portal in a common machine-readable format and are only sent to the purchaser after being electronically verified. These electronic invoices from small business accounting software contain all the information you would find on a paper invoice, such as dates, customer details, goods and services sold, invoices, and VAT breakdown, but stored electronically. And contains some fields. All taxpayers who live in India and issue invoices, and third parties who issue invoices on behalf of residents are subject to electronic invoicing.

How can Zoho Books help?

All businesses are required to send certain electronic invoices, debit notes, and credit notes from small business accounting software to the GST portal for confirmation. If the invoice is successfully validated, a universally unique identification number (UUID) and QR code will be generated and brought to the transaction. This makes it a legitimate electronic invoice as small business accounting software that the seller can issue to the buyer. With all the features you need built-in, Zoho Books is ready to make electronic billing less complicated for taxpayers. like this:

Easy one-time setup

Simply activate the Zoho Books electronic billing option and you'll have all the vital features and automation you need to upload your invoice directly to GST electronic billing portal in small business accounting software. In addition, you can personalize your invoice template to include a QR code and digital signature.

Curb unauthorized access

Per the GST guidelines, we do not permit anonymous access to transactions and records. Customers need to create safe and secure passwords, and may use multi-factor authorization to protect their accounts; they aren’t allowed to use the software program with a default or organization password. The admin user can assign get entry to all different customers so that they have to get entry to the suitable modules and capabilities for their roles. The system having small business accounting software additionally tracks user classes to create logs that may be accessed in real-time if important.

Create and manage e-invoices and associated notes

Smart Verification: Zoho Books as small business accounting software permits you to create and print error-free electronic invoices with all required fields. Transactions are pre-validated during invoice creation to identify violations, incorrect data entry, and missing required fields.

Bulk e-invoices: You can push invoices and their associated notes to the ZATCA portal in bulk for authentication. Your transactions will be authenticated and e-invoices ready within seconds.

Bulk e-invoices: Invoices and accompanying notes can be sent together to the GST portal for review. The transaction is confirmed and an electronic invoice is created within seconds inside small business accounting software.

E-invoice adjustments: Was the electronic invoice incorrect? Zoho Books allows you to create credit or debit notes with the appropriate values to fix the error.

Transaction Archive: A company must keep a record of all transactions for five years. Allows the user to execute a transaction and archive for the entire retention period.

The Free Plan of Zoho Books for Businesses

Zoho Books has been constantly helping businesses being small business accounting software solve their accounting challenges for over a decade. Small businesses were the backbone of Zoho Books and the constant impetus for our innovation. Today is the best time to introduce a free Zoho Books plan designed to meet the accounting needs of small businesses, beginners, and freelancers.

The free plan of Zoho Books

Zoho Books' free plan provides a modern cloud accounting platform as the best small business accounting software to replace traditional accounting or spreadsheet accounting, eliminating the risk of data loss and reducing costs, manual labor, and errors for small business financial worktop small business accounting software. The purpose is to transform the space. Free plans help you go paperless, automate your accounting responsibilities, and bring your accounting with you anyplace you pass.

With this free plan for small business accounting software, you can create, personalize, and send up to 1,000 invoices annually, collect payments online or offline, and automate payment reminders. You can also add expense receipts to track expenses by category and keep them within your budget. When you enable the Customer Portal, customers can view pending invoices, comment on transactions, make payments online, and comment.

The free plan also helps you to add bank and credit card accounts, import card statements, and coordinate transactions. The small business accounting software keeps track of your cash flow with 25 comprehensive reports on sales, accounts receivable, and key business financial monitors such as profit and loss and balance sheets.

Want to know how to start a free plan?

Zoho Books' free plan is forever free as long as your company's total revenue is within the thresholds of the free plan for the fiscal year especially set for each region. In small business accounting software Sign in and get started right away! All you need is your email address, no credit card details. See the full list of free plan features and sign up now.

Introducing the Free Edition of Zoho Books for Businesses in India

Small businesses makeup at least a quarter of India's economy and employ a significant portion of India's workforce. However, many of these business owners are obsessed with manually filling out spreadsheets and ledgers. This is time-consuming, repetitive, and error-prone. The Government of India has created initiatives such as Atmanirbhar Bharat and Digital India to facilitate the digitization and expansion of enterprises, and Zoho Books is recognized as the winner of the Aatmanirbhar Bharat Application Innovation Challenge.

What does the free plan offer?

To make online accounting available to everyone inside the small business accounting software, our free plan provides all the basic accounting features that any business needs to manage its finances. Here's what you can do:

Manage receivables and payables

Once started, you'll be able to send a quote, convert it to a GST invoice, send a reminder, and track all the incoming money. You can also generate purchase orders, share them with your suppliers, record the corresponding invoices, and easily manage your withdrawals.

Organize contacts and collaborate with clients

You will be capable to add all your customers and suppliers and manage their transactions. Zoho Books also allows customers to access the customer portal to see the status of their transactions and accounts.

Monitor stock

Free plans permit you to track and adjust inventory levels, keep track of reorder points to restock when out of stock, and organize inventory with important information such as SKUs, costs, and inventory. It also includes basic stock tracking to do.

Stay GST compliant

You can enroll in a GST-compliant transaction, generate a GST report, and set up an approval process before submitting a return directly. You can also create shipping challans and generate electronic invoices for the goods you want to ship.

Accounting on the go

Manipulate your budget anywhere you are with the Zoho Books cell and windows pc programs for Android and iOS. You may download it for free from the App Store or Play shop and begin with the equal account you operate for Zoho Books on the web.